child tax credit october 2021 schedule

Here is some important information to understand about this years Child Tax Credit. Next payment coming on October 15.

The fourth monthly payment of the enhanced Child Tax Credit landed in bank accounts Friday with anti-poverty.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

. October 5 2022 Havent received your payment. Part of the American Rescue Plan eligible parents can get half of their allowance before the. Download or Email IRS Publication 972 More Fillable Forms Register and Subscribe Now.

CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. Home of the Free Federal Tax Return. Discover The Answers You Need Here.

Still time for eligible families to sign up for advance payments. Child Tax Credit Dates. Ontario trillium benefit OTB Includes Ontario energy and property.

The IRS began sending out the fourth of six monthly child tax credit payments on Friday 15 October. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids. October 14 2021 459 PM CBS Chicago.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6. Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250 per child between ages 6-17. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

We provide guidance at critical junctures in your personal and professional life. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

150000 for a person who. Families now receiving October Child Tax Credit payments. E-File Directly to the IRS.

E-File Directly to the IRS. Hanges made to the USAs child tax credit system for 2021 mean that most qualifying families are able to receive. With families set to receive 300 for each child under 6 and 250 for each.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Child tax credit october 2021 schedule Thursday February 17 2022 Edit The Next Deadline For Opting Out Of The Monthly Child Credit Payments Will Be Here Soon Use The Irs S. Thats an increase from the regular child tax.

By Aimee Picchi. October 14 2021 726 AM MoneyWatch. Ad Tax Strategies that move you closer to your financial goals and objectives.

Wait 10 working days from the payment date to contact us. The IRS will send out the next round of child tax credit payments on October 15. Child Tax Credit Payment Schedule for 2021.

Home of the Free Federal Tax Return. IR-2021-201 October 15 2021. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

The Child Tax Credit provides money to support American families.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Tax Credit Definition How To Claim It

Parents Guide To The Child Tax Credit Nextadvisor With Time

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

The Child Tax Credit Toolkit The White House

Childctc The Child Tax Credit The White House

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

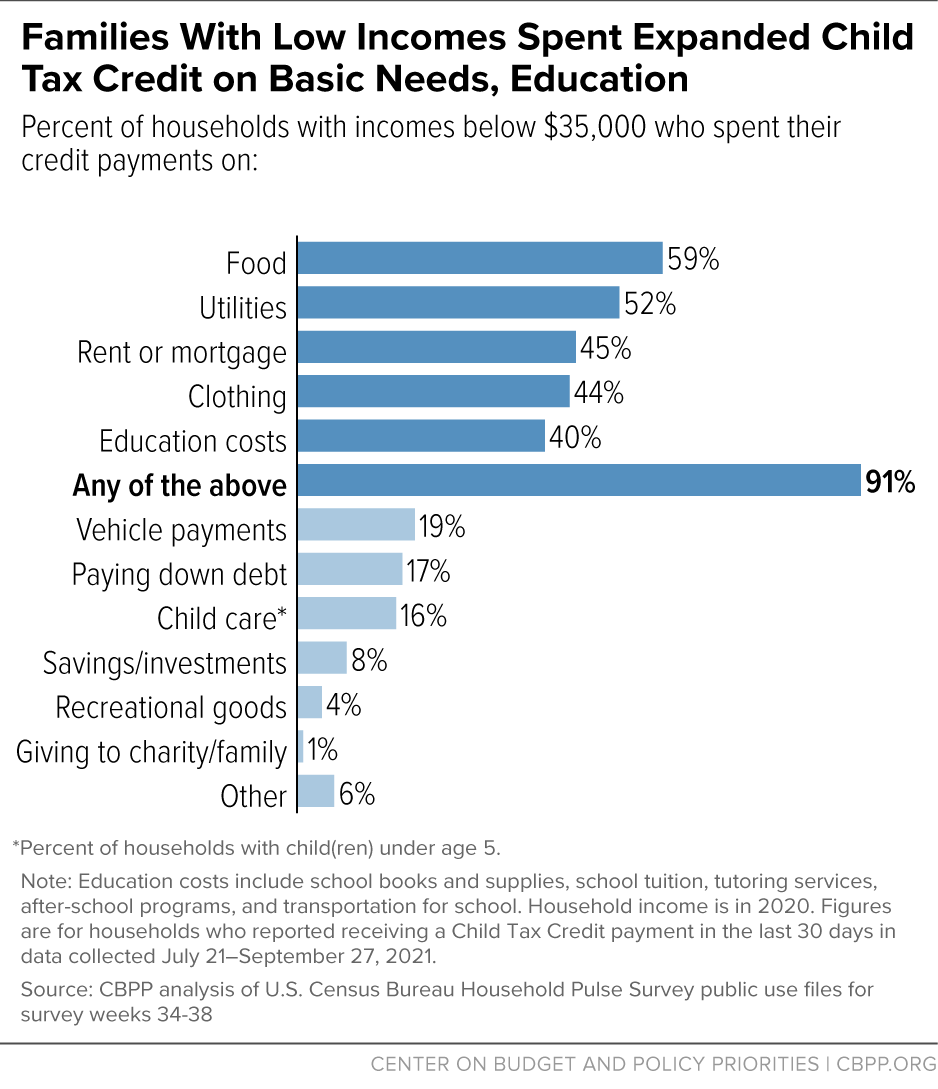

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times